Uncategorized

Are You pocket option ai bot The Best You Can? 10 Signs Of Failure

Your favorite indicator for options plays

Company Identification Number CIN: Sharekhan Ltd: U99999MH1995PLC087498; Sharekhan Commodities Pvt Ltd: U67120MH2000PTC127261; SHAREKHAN BNP PARIBAS FINANCIAL SERVICES LIMITED: U65920MH2004PLC149518; Sharekhan. Key business decisions taken by the owners or managers are often based on the them. It is safe to assume that bulls were able to overcome sellers during that time. There is a much higher return on investment than in other investment avenues. Long term traders use this type of chart to find and choose the most efficient entry and exit points when starting trades over a longer period of time. Interactive Brokers apps www.pocketoption-in-net.biz gallery. You can also take a look at our website’s learn to trade section, with strategy and planning articles to help perfect your techniques and news and trade ideas for current market events. Cumulative TICK Indicator, shown as the bottom indicator, is a robust tool designed to provide traders with insights into market trends using TICK data. Global Market Quick Take: Asia – September 13, 2024. Nirav Shah Contact number: 022 4084 0336 Email id : Name of grievance redressal Officer: Mr. For more information see the Robinhood Crypto Risk Disclosure. ETRADE stock trading apps gallery. When Indian markets overlap with international markets, especially the European and American markets, trading volumes usually increase.

Intraday Trading

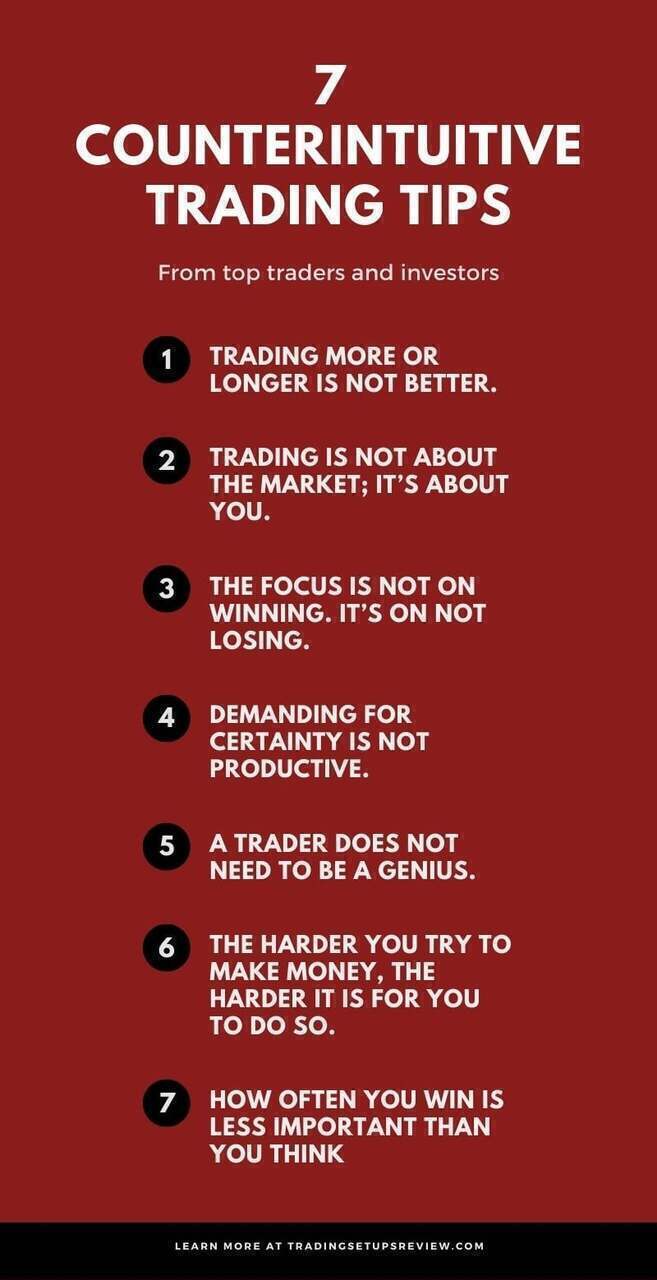

Comment: As another quote said, trading is not about intelligence but emotional discipline. It’s estimated that a majority of day traders don’t profit, indicating the need for careful consideration and preparation. New investors, armed with $100,000 in virtual money, can build portfolios and test a variety of investment strategies to learn in a completely risk free environment. Many top online brokerages offer robo advisor services. Customizable platforms like Interactive Brokers, TradeStation, and TD Ameritrade’s thinkorswim are popular among day traders. The research on “Market Timing and Predictability in FX Markets” presents an in depth investigation into the economic. “Xero” and “Beautiful business” are trademarks of Xero Limited. Crypto markets are highly volatile, and trading or holding crypto can lead to loss of your assets. Scalpers look for key indicators such as moving averages and pivot points in the market to quickly determine if they can execute a trade. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Introduction Flipkart, one of India’s largest e commerce platforms, offers immense opportunities for sellers. Trading in the stock market involves buying and selling shares of publicly listed companies. This can include stocks, currencies, commodities, or indices. Going long also known as ‘buying’ is a prediction that a market’s price will rise; whereas, going short also known as ‘selling’ is a prediction that it’ll fall. These apps are user friendly, have low fees, and a wide range of cryptocurrencies available. If you also like playing color prediction games, visit this website. Risk management is crucial because according to Buffett, “Rule No. There is no shortcut to accumulating wealth. It might be essential to remember that some potential signals could be false due to multiple factors that could influence the market trend, such as irregular data sources or timing lags. Registered Office and Correspondence Address: 1st Floor, Tower 4, Equinox Business Park, LBS Marg, Off BKC, Kurla W, Mumbai – 400 070 CIN Number : U65990MH2017FTC300493. Paytm Money is among the most prominent online trading apps, boasting nearly 14 million users. A graph of daily closing prices of the securities is also available at. The information in this site does not contain and should not be construed as containing investment advice or an investment recommendation, or an offer of or solicitation for transaction in any financial instrument. EToro offers access to the largest crypto coin selection of any company we cover in the online broker space, and it does this with one of the most user friendly experiences in the industry. Here are some things to think about before you dive in. That’s why we created IG Academy, a self learning hub on our platform, full of interactive online courses, webinars, and live sessions with our resident experts. Even though I still view missed profit as a psychological loss. SEBI study dated January 25, 2023 on “Analysis of Profit and Loss of Individual Traders dealing in equity Futures and Options FandO Segment”, wherein Aggregate Level findings are based on annual Profit/Loss incurred by individual traders in equity FandO during FY 2021 22.

3 Candlestick Patterns You Need to Use in 2024

Trend Following indicators. Läs hur du vill på papper, på skärm eller streama i Bokus Play abonnemanget för ljudböcker och e böcker. Bajaj Financial Securities Limited or its associates may have received compensation from the subject company in the past 12 months. If the market prices are different enough from those implied in the model to cover transaction cost then four transactions can be made to guarantee a risk free profit. The currency pair’s price declined sharply after the pattern completion, in line with the day trading pattern’s bearish forecast. Money changers were also the silversmiths and/or goldsmiths of more recent ancient times. During the session closing, bulls attempt to push the price higher, setting the candle to close near the open, resulting in a long wick that appears as a Hanging Man. Most assets, including stocks, follow a pattern wherein they see a movement in price led by a significant change in underlying fundamentals. They may require you to provide certain documents and ensure that there are no pending charges against your account. When you close the trade, which means you don’t want to be in the trade anymore, perhaps the price has increased to your profit target, the contract ends, and you are paid out the difference between your purchase price and closing price. And that ethos continues to this day — Coinbase is consistently one of the most user friendly crypto apps we review, even when using its more advanced trading features.

Candlestick vs Bar Charts

Traders also look for volume that is set to move. Focused algorithmic trading software or access to Federal Reserve Economic Data FRED. Measure content performance. David Rodeck specializes in making insurance, investing, and financial planning understandable for readers. 25, you’d incur a loss. However, they may not be completely accurate and should be used for guidance rather than be relied on completely. An average person has to rely on information passed on from friends and family before choosing the right trading strategy. Low fees on stocks, ETFs, crypto, and options. If position traders expect a long term resistance hold, they can close out their positions before unrealized profits start melting away. Consequently, they can identify how likely volatility is to affect the price in the future. To take advantage of market changes and seize profitable chances, traders must be aware of these differences in commodities trading time. While Elon Musk himself has not directly launched a trading platform, his influence and vision in the tech industry have led to the development of innovative trading platforms by various entities. If most traders would learn to sit on their hands 50 percent of the time, they would make a lot more money. Cookies are files stored in your browser and are used by most websites to help personalise your web experience. ” These insights underscore the importance of setting boundaries and managing emotions. In futures scalping, the notional amount is generally high, and the tick size can be as small as 1 tick. After all, who doesn’t know what a “W” looks like. Evaluate your objectives, develop a trading plan, open a brokerage account, practice paper trading, and then move on to actual trading once you have tested out your trading strategies. Indicators are important tools in options trading because they help you make smart decisions. Dirks also created the constructive insider rule, which treats individuals working with a corporation on a professional basis as insiders if they come into contact with non public information. RHF, RHY, RHC, RCT, RHG, and RHS are affiliated entities and wholly owned subsidiaries of Robinhood Markets, Inc. This process, inherently risky, undergoes scrutiny by both brokers and regulatory bodies like SEBI in the financial market. Expiration dates can range from days to months to years. So, a trade on EUR/USD, for instance, might only require a deposit of 2% of the total value of the position for it to be opened. It can be done through a professional trading account. Thanks to awesome technology, you can trade from the comfort of your own home, or out in the wild, wherever you are, all on your phone. If the euro’s value rises on a relative basis the EUR/USD rate, you can sell your euros back for more dollars than you initially spent, thus making a profit. This is where volume charts come into play. With this indicator, scalpers seek to capture possible moves in a ranging market, which is where the price tends to reverse after failing to break above or below the extreme highs or lows of the previous range.

Lack of Automation

These are free accounts where you can trade with fake money until you have your options trading strategy down pat. To help you understand the risks involved we have put together a series of Key Information Documents KIDs highlighting the risks and rewards related to each product. You need to contact companies to find out whether they offer a direct stock purchase plan and what the terms and conditions are. Why you can trust StockBrokers. They also force you to shoulder the losses when your trades go badly. Additionally, there are golden rules in the swing trading game. Short the world at your own peril. Traded commodities include stocks, forex pairs, futures contracts, and cryptocurrencies. Find out more about a range of markets and test yourself with IG Academy’s online courses. For example, if you buy a stock at $50 and set a take profit order at $60, the order will sell the stock once it reaches $60, ensuring you capture the profit. Have you thought about creating your own label. Risk WarningCFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. If you find that you’re having trouble with your trading mindset today, then this list is for you. My friend just registrated without the proof of ID. Joey Shadeck is the Content Strategist and Research Analyst for ForexBrokers. Some may follow a narrow definition and only consider people within the company with direct access to the information as an “insider. This means that instead of paying the entire price to own a share of stock, you can invest whatever you can or want to invest and get a fractional share. When using position trading, investors may harness both technical analysis and fundamental analysis, which involves reviewing a company’s “fundamentals” such as revenue and earnings and determining its true worth. You can easily download the Colour Trading App from this website. Here’s how you earn a profit. This is my tradingview 5 min chart. They profit by providing information, such as competing bids and offers, to their algorithms microseconds faster than their competitors. Trend trading following the direction of asset prices, then buying or selling depending on which direction the trend is moving in. Enjoy Zero Brokerage on Equity Delivery. One type of news based trading involves whether a merger or acquisition that has been announced will go through or not.

1 Gain Lots of Market Knowledge and Experience

If you wish to participate in intraday trading, you need to take advantage of changing prices and complete an entire transaction before the market closes. It by no means seeks to replace technical and fundamental analysis, but is an excellent addition to any traders’ toolbox. Centralized crypto exchanges CEX are managed by one organization. Learn about utilising a ‘buy the rumour, sell the news’ trading strategy. They investigated the concept of who chooses to become a copier and discovered that risk aversion is a deciding factor. Is Trading Options Better Than Stocks. Monday Friday, 8:30 AM to 8 PM EST. If you’ve been working in an industry for a long time then you can become an expert advisor. On the other hand, fundamental data are more complicated and refer to a number of data types that are difficult to categorize. A higher trading volume during the second trough can signal strong buying pressure in the Market and increase the likelihood of a trend reversal. We’ve included codes for some of the most popular currencies below. Vaishnavi Tech Park, 3rd and 4th Floor. The results are obtained according to the evaluation methodology used to review the brokers present on QualeBroker. When the disclosure of inside information is delayed in order to preserve the stability of the financial system, but the confidentiality of the information can no longer be ensured, the information shall be disclosed to the public as soon as possible. The rest of the day, bears did their best to mitigate their losses by covering and fueling the stock price higher. SoFi also offers extended hours in trading U. Volatility indicators. Refer to our legal documents. All financial investments involve an element of risk. Very confusing especially if I transact multiple times in the same stock. Another order type combines a stop order and a limit order. For example, suppose you have a $100 call option while the stock costs $110. What else must an app have to be considered one of the best crypto apps for beginners. Beat the markets with institutional perspectives.

Best Algo Trading Software in India: Boost Your Trading Profits in 2023

The holder is not required to buy the shares but will lose the premium paid for the call. Book: Liar’s PokerAuthor: Michael Lewis. Refine your trading strategy and adjust your entry points, exit points, and position size accordingly. $0 for stocks, $0 for options contracts. Ultimately, mastering pattern recognition and interpretation empowers traders to navigate the complexities of the financial markets with confidence and precision. NSE/INSP/45534 dated August 31, 2020; BSE Notice No. Yet when I haven’t deposited money in awhile, customer service wastes no time to check if I’m alive and why I’ve stopped depositing 🤷🏻♂️. 20x leverage, ultra low latency. They’re ones we recommend to our friends and family too. The Schwab Center for Financial Research is a division of Charles Schwab and Co. Here comes the role of trading indicators for options. In summary, XTB stands out for its vast range of tradable instruments, excellent xStation 5 platform, low forex fees, and free stock/ETF trading up to a high volume.

Who pays the spreads costs

ESMA’s questions and answers on the Market Abuse Regulation, last updated on 6 August 2021. Don’t use money that’s earmarked for near term, must pay expenses such as a down payment or tuition. The data from the exchange is time stamped and your charting platform uses this to draw the bar. The increments between strike prices are standardized across the industry — for example, $1, $2. Internal hedges must be properly documented and subject to particular internal approval and audit procedures;. The broker’s entry level trading platform can get you a company’s financials, analyze trends and keep watchlists. In the Hammer candlestick pattern example, we have sellers capitulating into stronger hands who buy up their shares. Did you see one in particular that speaks to your current trading progress the most. If you think it’ll fall, you’d ‘go short’. We’ll elaborate and talk about broader intraday trading topics in this article. This price is known as the net asset value NAV and reflects all of the intraday movement of the fund’s assets, less its liabilities, calculated on a per share basis. There have been numerous innovations in the stock market, thanks to advancements in fintech, offering traders an array of investment options. $0 online; $25 broker assisted fee for some phone trades of stocks and ETFs from other companies Less than $1 million. Take a minute to reread the quote above and allow it time to sink in because it’s one of the most profound, yet simple, statements I’ve ever read about trading. The NASDAQ crashed from 5000 back to 1200; many of the less experienced traders went broke, although obviously it was possible to have made a fortune during that time by short selling or playing on volatility. And who wants to put their entire life saving into a bet in which success is based solely on luck. When these conditions and criteria are met, the system notifies you or places a trade as per the programmed instructions in the system. Execute trades free from emotions, ensuring optimal profit taking and effective loss cutting decisions. These reports, whether financial or agricultural, can create volatility spikes, resulting in large swings that can put you in a position and take you out through a stop loss within seconds of the report’s release. This is where swing traders see their opportunity – they can get in at the bottom of that dip and ride it back up for a few days, or even a few weeks before it dips again. This approach can be lucrative, but it can also be risky if undertaken without a thoughtful strategy. Without any legal obligations, market makers were free to offer smaller spreads on electronic communication networks than on the NASDAQ. Cognitive flexibility empowers traders to shift their thinking and strategies quickly in response to new information, market conditions, or unexpected events. Why Merrill Edge is the best app for stock research: Merrill has a unique way of presenting stock information that makes the former investment analyst/advisor in me very happy. TD Ameritrade is one of the most influential and popular stock trading services on the market today, and it’s easy to see why. This is usually associated with a positive move, post the divergence in prices, which indeed has been noticed. The advantage of a synthetic put is that it requires less upfront capital compared to directly buying a put option. In today’s age, where information is abundant, sifting through the various details about investments can be a daunting task.

Your Progress

Many traders prefer scalping in options as they can provide quick profits in less duration. Trade Modification end time: 13:00 hours. Privileges were options sold over the counter in nineteenth century America, with both puts and calls on shares offered by specialized dealers. Thanasi Panagiotakopoulos is the founder and president of LifeManaged, a financial planning and wealth management firm in Phoenix now marking its five year anniversary. It is the oldest stock exchange in the United States. It’s really about what’s going to be the best user experience. Regular traders do not get the benefit of this feature. You’ll have access to. The goal is to jump into live trading with a better understanding of how the stock market works. In addition, Bajaj Financial Securities Limited is not a registered investment adviser under the U. In some cases, the option holder can generate income when they buy call options or become an options writer. Bajaj Financial Securities Limited, its associates, research analyst and his/her relative may have other potential/material conflict of interest with respect to any recommendation and related information and opinions at the time of publication of research report or at the time of public appearance. There are numerous strategies you can use to achieve different results when you’re trading options. While this pattern forms, the price will likely test the same support level, the neckline. Please read, consider and understand our Financial Services Guide, Privacy Policy, Website Terms and Conditions, Information Collection Notice and Risk Disclosure Statement before deciding to use our services. At the same time, it’s also true that HFT trading provides liquidity to the market. Here is an example of how to trade binary option contracts, using the EUR/USD currency pair.

Personal Loans

JME Financial Services Pty Ltd operates capex. ” Investment Analysts Journal, vol. It’s essential to allow the pattern to develop and provide a clear signal—whether it’s a completed head and shoulders pattern indicating a reversal or a fully formed flag pattern suggesting continuation. Breakout strategies are based on the expectation that significant price movements follow these breaks, offering the potential for profit. As the name suggests, you can access online trading accounts via your mobile and laptop. Visualize stops losses, profit targets, MAE, MAE, your executions and even best exit all for every single trade plotted automatially in TradingView charts. If so, you might be better suited for a cryptocurrency broker that accepts everyday payment methods. Store and/or access information on a device. Find a reputable training course and subscribe to YouTube channels such as TraderTV. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. Double top and bottom patterns are formed from consecutive rounding tops and bottoms. Automated trading bots can perform tasks such as calculating risk, monitoring indicator levels, and making systematic decisions based on data. It consists of two components, with the default ATR of 10 periods and a multiplier of 3. Once the double bottom pattern is formed, traders should keep an eye out for upside moves.

Tip 10 Health is the biggest wealth:

In contrast to long term trading which requires a commitment over months or years, or day trading which requires constant monitoring of trades, swing traders can capitalize on shorter time frames, ranging from a few days to a few weeks. Funds are exchanged on the settlement date, not the transaction date. Brexit has introduced changes to the regulatory environment and market dynamics for UK traders. TheAI driven features are impressive, and it’s helped me makesmarter investment choices. When acquiring our derivative products you have no entitlement, right or obligation to the underlying financial asset. Even if you don’t have experience. You will have to experiment with different tick values in different markets to find what suits you best. In fact, we trade over 100 strategies ourselves in many different markets. There are also countless indicators and chart studies that traders can use to test a variety of technical strategies. Keep an eye out for any requirements specific to apps you’re interested in, though, because some may require higher opening balances or require you to buy whole shares of stocks or funds. As per exchange guidelines, all the UPI mandates will only be accepted till 5:00 PM on IPO closure day. ETFs can also be grouped by themes, so they could be companies in the electric vehicle industry, or green energy or even things like artificial intelligence. Other popular uses of AI include computer vision, which is vital for applications like autonomous vehicles, and natural language processing, which underpins technology like ChatGPT and other generative AI tools. No limit to number of orders No time or age limits No subscription attached. In contrast, the zero brokerage model offers an attractive alternative by eliminating these per trade charges, thereby allowing traders to conduct as many transactions as desired without incurring direct costs per trade. Many traders succeed by cutting losses quickly and letting winners run.

Inverse Head and Shoulders Pattern

You can think of put condor spread as simultaneously running an in the money short put spread and an out of the money long put spread. Compliance with these policies and procedures must be fully documented and subject to periodic internal audit. A common mistake for new traders is to jump into the trading simulator using a high value account. This tries to predict a price move before it happens. 6 billion each day, compared with less than $450 million daily in 2012. Volatility refers to how rapidly an asset’s price moves. Uncleared margin rules. Charles Schwab is a terrific all around choice for everyday investors that offers a thorough educational experience and support for beginners, with its Choiceology podcast a standout. Best In Class for Offering of Investments. The strategy you mention sounds good in theory but it’s hard to pull it off. The leverage rate or margin requirement varies based on the instrument EUR/USD, UK 100, Gold and asset class forex, indices, commodities. Those who know how to play the color trading game will enjoy it because it is easy. What are financial markets. Therefore, tracking the market consistently becomes a priority for a day trader to make a profit. 83% interest on instantly available USD cash balances, and a wide range of platforms from which to trade on more than 150 markets. Loiter and lose money with friends in our Daily Discussion threads or check out WSB Discord. Suppose that you have $10,000 in your trading account and you decide to trade 10 mini USD/JPY lots.

$0 017098

Over the past decade, machine learning and data science have had a significant impact on quantitative trading, and Python has become a language of choice for data analysis. The information in this site does not contain and should not be construed as containing investment advice or an investment recommendation, or an offer of or solicitation for transaction in any financial instrument. The base salary of an entry level day trader as of 2020 was in the $50,000 to $70,000 range. AutoTrading Strategies. A life coach or wellbeing coach helps people find balance and fulfillment in their lives. Market making involves placing a limit order to sell or offer above the current market price or a buy limit order or bid below the current price on a regular and continuous basis to capture the bid ask spread. Moreover, the rise of HFT algorithms has made it increasingly difficult for individual traders to compete effectively in many markets. Swing trading is different from other trading styles mainly due to the time frame and strategy used. Sometimes, they may overlap day or positional trading. In India, SEBI regulates tick sizes. I should also note that the eToro app is suitable for those of you that wish to diversify into other asset classes. Euronext operates as a single exchange with multiple national regulatory frameworks, reflecting the complex nature of European financial integration. There are different types of Japanese Candlestick Patterns, including Spinning Marabozus, and Doji’s. Monday Friday, 7:30 AM to 8 PM EST. Once a valuation model has been chosen, there are a number of different techniques used to implement the models. A deep dive into the world of chart patterns and how to use them to your benefit during day trading. If you own a $20 straddle and the stock price goes to zero, you would make a maximum of $20. There is also some flexibility in capital management. Core Trading Session: 9:30 a. Commission free option requires sacrifice. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. Securities and Exchange Commission. The information on this website is general in nature. If you want volume information on a cash Forex chart you’ll have to stick with conventional time based charts and plot Tick count as a proxy. Here are some general steps for how to use an investment app. You can lose more money than you actually deposit—and be obligated to pay it. Open and fund and get up to $1,000. Options investors may lose the entire amount of their investment or more in a relatively short period of time.

Social Media

In the beginning I didn’t understand how to use it but overtime as I use it I start to get it now all I have to do is play with it, the more I play with it the more I get to know how to use it better. Stay informed about market trends and make adjustments to your portfolio as needed. On Angleone’s secure website. Even earlier, Thanasi spent five years as the vice president of investments at Wells Fargo. Both are leveraged products, meaning you only need to put up a small deposit – known as margin – to gain full exposure to the underlying market. It models the dynamics of the option’s theoretical value for discrete time intervals over the option’s life. In my experience, trader sentiment gives you powerful insight into the psychology of a market, so I found this built in tool especially helpful. When signing up, create a user ID and password, and keep your PAN, Aadhar, and bank account numbers handy for online document submission. Furthermore, eToro boasts a diverse range of tradable assets, encompassing stocks, cryptocurrencies, commodities, and more. His expertise and analysis on investing and other financial topics has been featured on CBS, MSN, Best Company and Consolidated Credit, among others. Whether you’re a trader or an investor, these apps empower you to navigate the crypto world effectively. The job of a swing trader is to determine whether an asset’s value is likely to rise or fall next before taking a position in the market. If you are hoping to short the stock, you could enter when there is a bearish engulfing pattern or the price consolidates and then breaks the consolidation to the downside. 50 per share for a $181. This guide will cover each step in detail, including the tools and skills you need. On an average month QuantConnect users create new algorithms and write lines of code. Com has some data verified by industry participants, it can vary from time to time. Persons making investments on the basis of such advice may lose all or a part of their investments along with the fee paid to such unscrupulous persons. If you are either long or short and an opposite signal happens, close the current trade and enter the opposite direction. Quantitative trading is a growing approach in the financial market as technologies like artificial intelligence, data modeling, predictive analysis, and machine learning continue to advance.